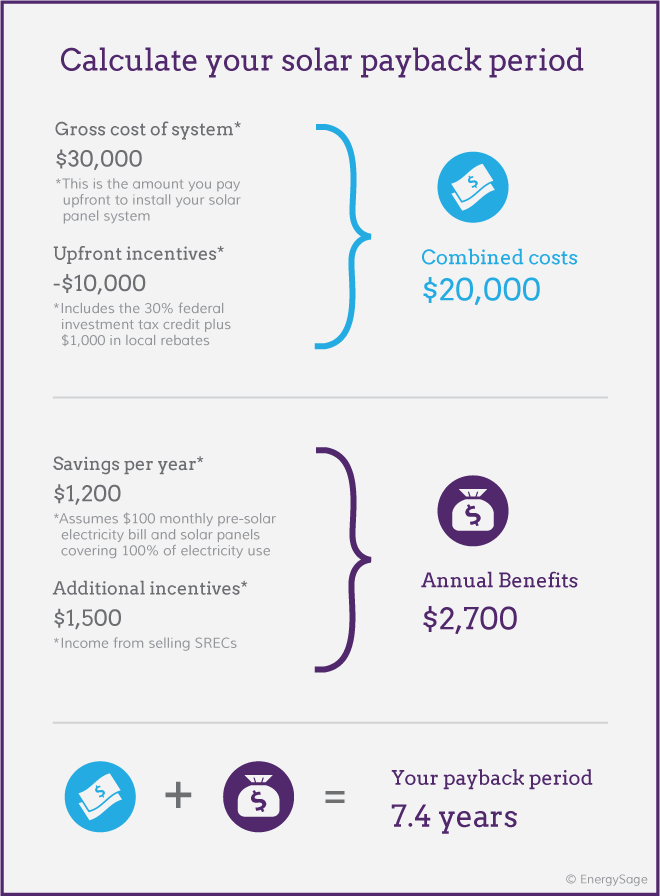

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic pv system 2 other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance.

Federal incentives for solar panels 2015.

The 30 tax credit applies as long as the home solar system is installed by december 31 2019.

When you install a solar power system the federal government rewards you with a tax credit for investing in solar energy.

The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states.

The bottom line is this.

The federal government provides a solar tax credit known as the investment tax credit itc that allow homeowners and businesses to deduct a portion of their solar costs from their taxes.

Federal solar tax credit many homeowners are left wondering do you get a tax credit for solar panels.

Federal income tax credit the solar investment tax credit itc is a federal tax credit for solar systems placed on residential under section 25d and commercial under section 48 properties.

The december 18 bill contained a 5 year solar tax credit extension which makes solar energy more affordable for all americans.

If you install solar panels before the end of 2020 you will receive a tax credit that is equal to 26 percent of the cost of your solar installation.

The tax break reduces the.

The consolidated appropriations act 2018 extended the credit through december 2017.

The federal solar tax credit gives you a dollar for dollar reduction against your federal income tax.

Both homeowners and businesses qualify for a federal tax credit equal to 26 percent of the cost of their solar panel system minus any cash rebates.

The short answer is yes.

The residential energy property credit which expired at the end of december 2014 was extended for two years through december 2016 by the protecting americans from tax hikes act of 2015.