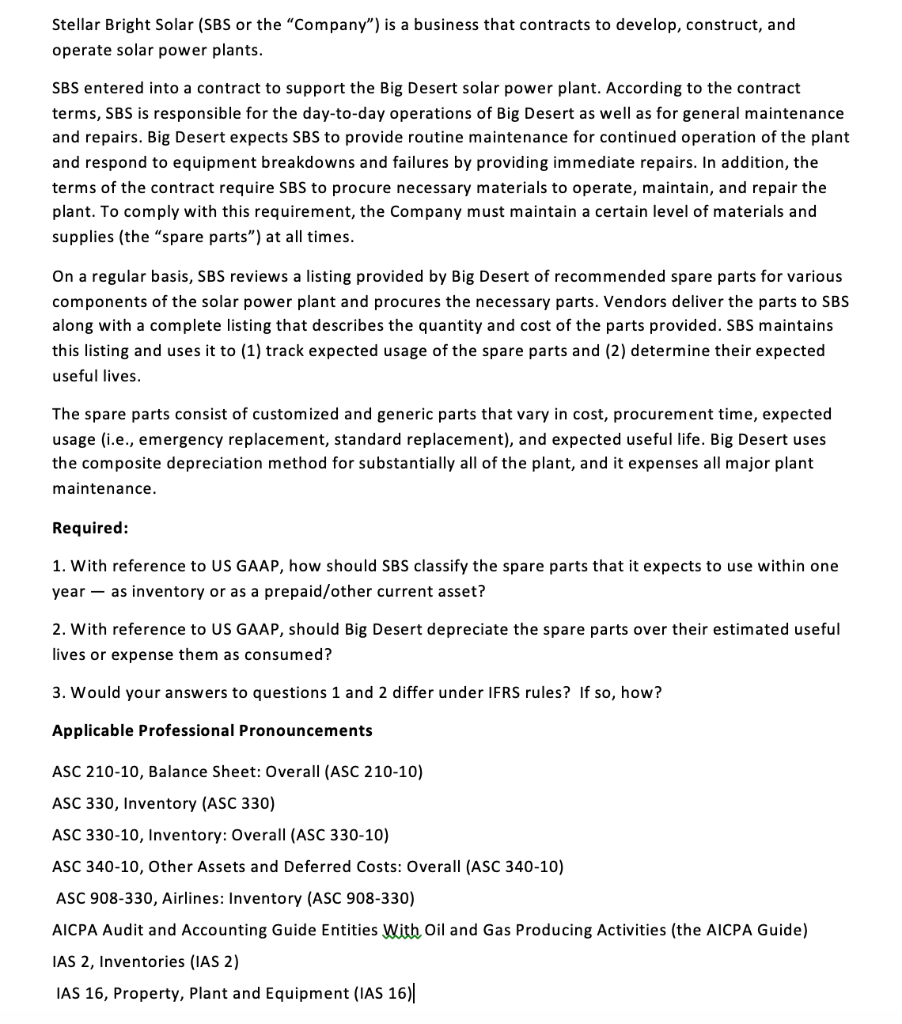

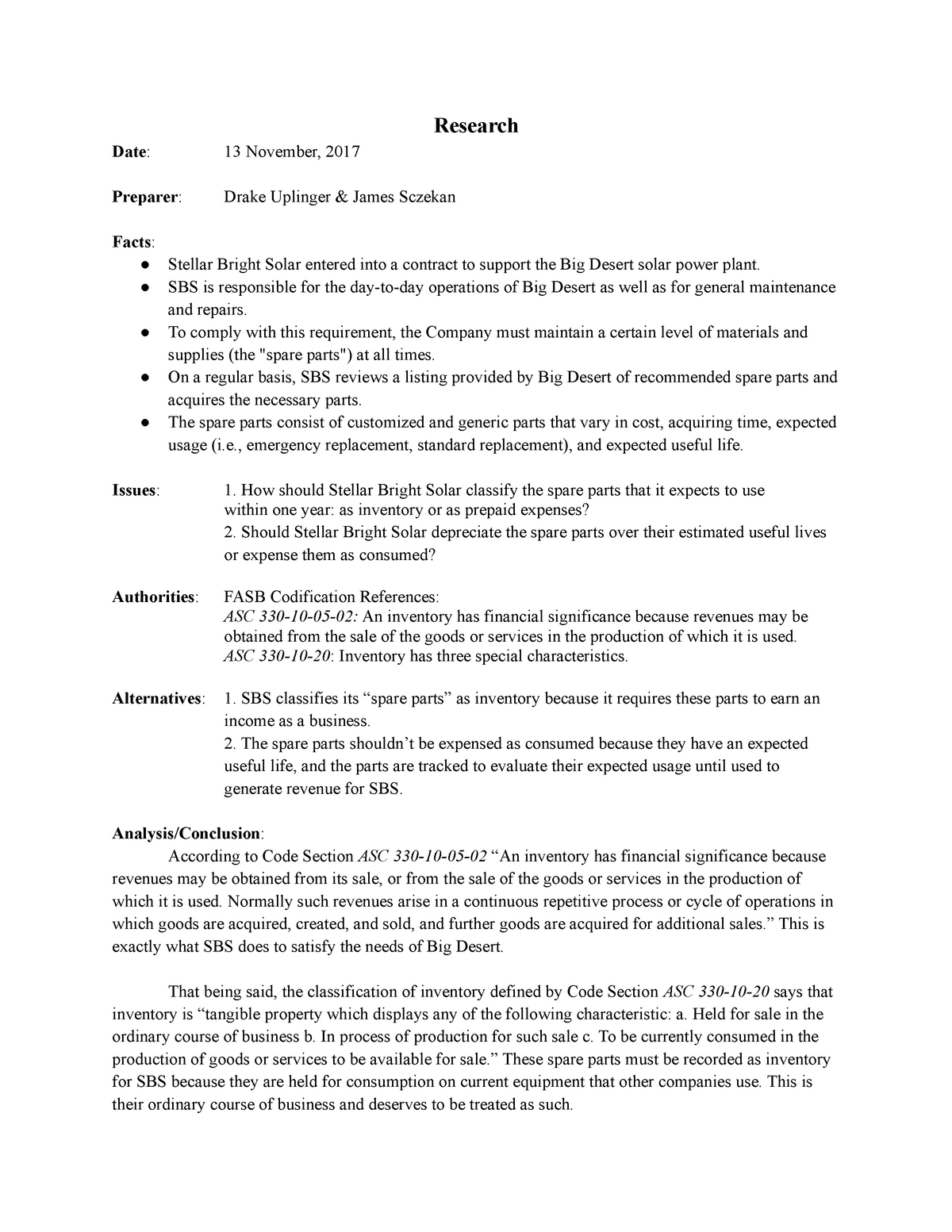

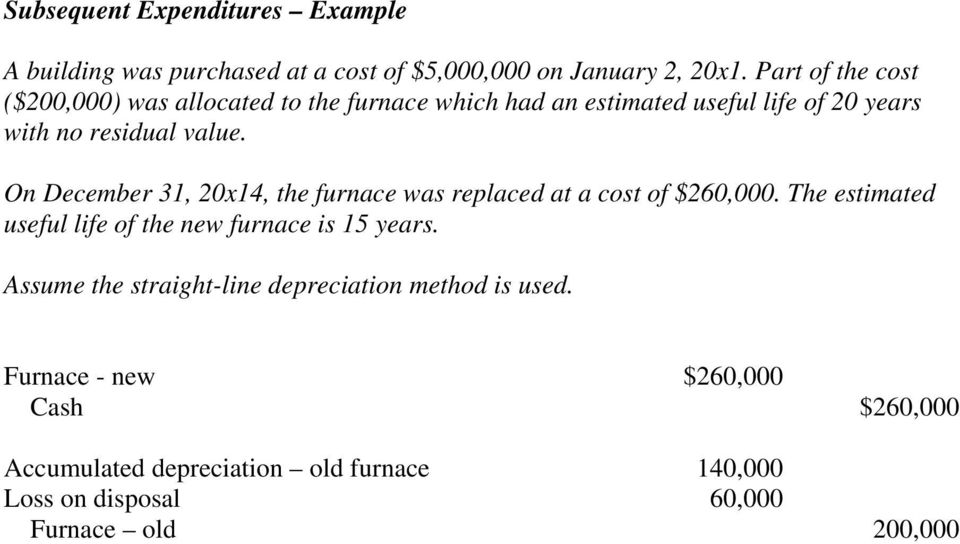

With half of the 26 tax credit deducted from the price the basis of depreciation for the solar system is 435 000 and the total savings from depreciation will be 134 850.

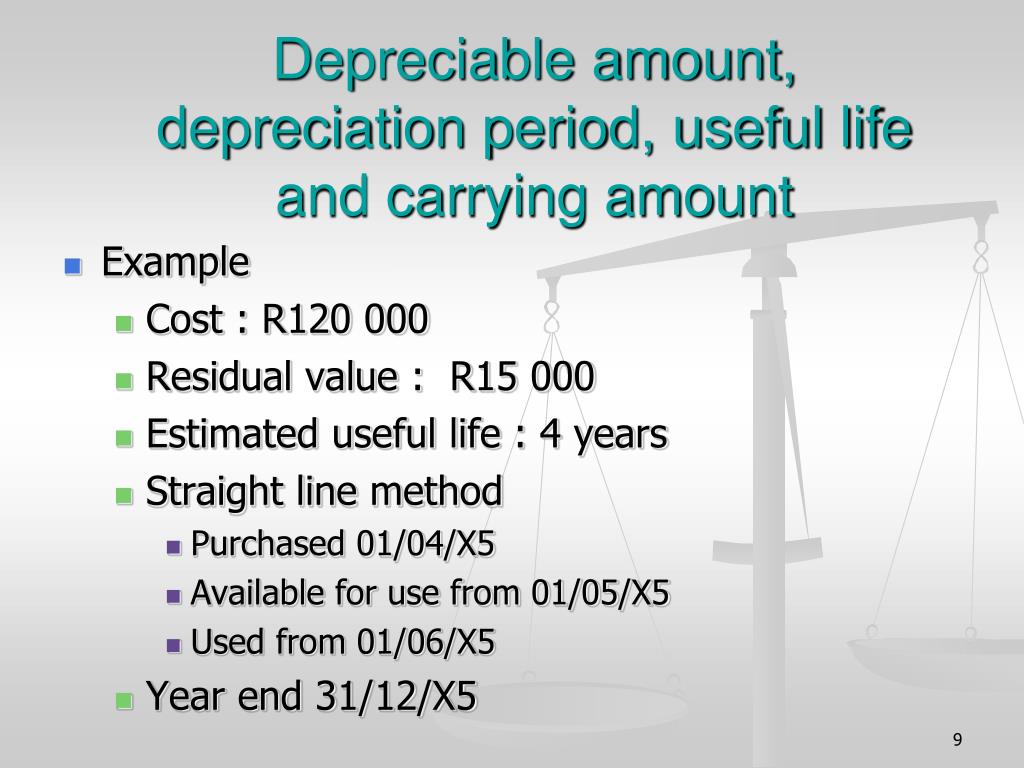

Estimated useful life for solar panels for depreciation.

Solar energy systems have been determined by the irs to have a useful life of five years.

Established a basis in solar panels and related equipment for purposes of claiming an energy credit under secs.

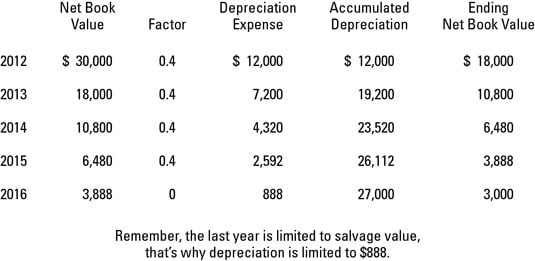

But let s take a look at the five year depreciation schedule.

So solar panels meet all the three criteria.

Satisfied the requirements of then applicable sec.

46 and 48 and a special allowance for depreciation under sec.

Let s have a look at how depreciation in solar benefits small businesses.

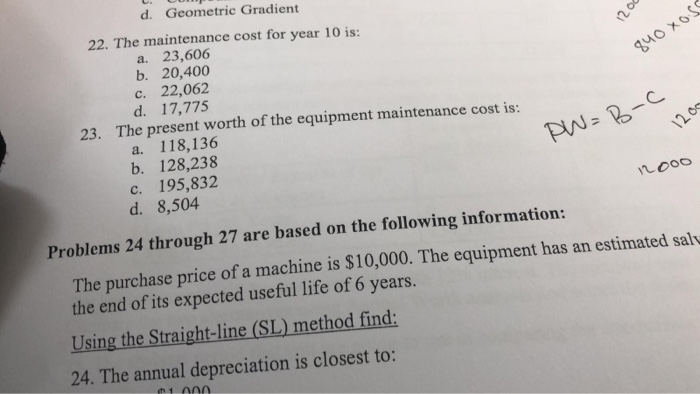

Year 1 20 year 2 32 year 3 19 2 year 4 11 5 year 5 11 5 and year 6 5 8.

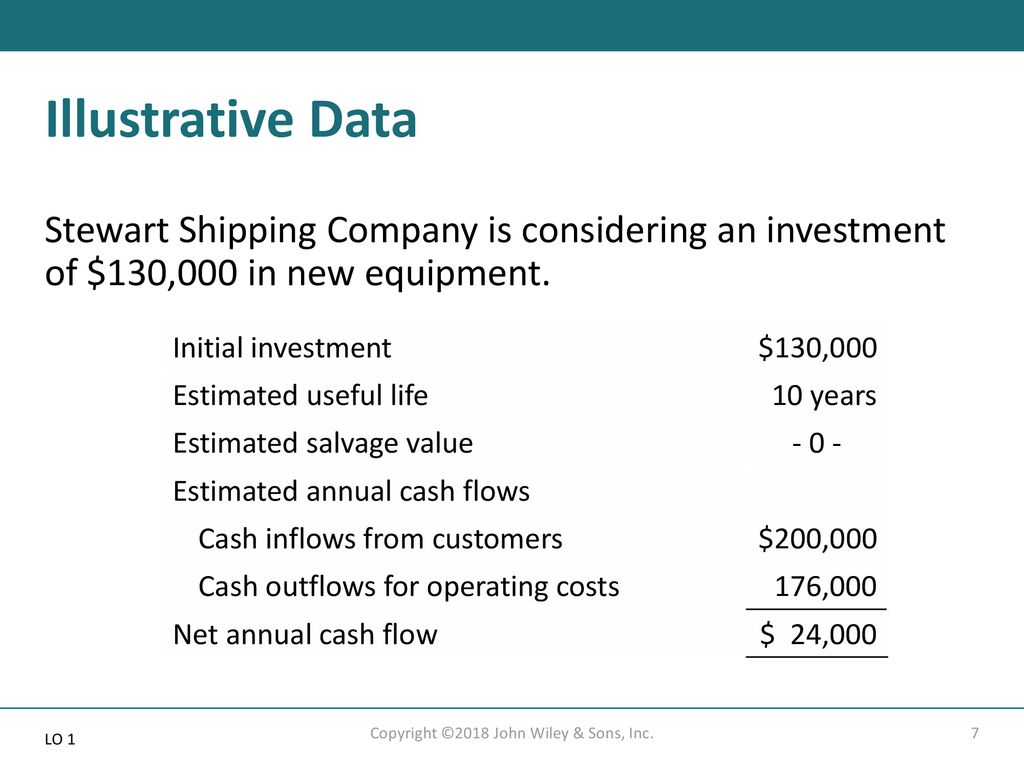

The modified accelerated cost recovery system macrs established in 1986 is a method of depreciation in which a business investments in certain tangible property are recovered for tax purposes over a specified time period through annual deductions.

Normally the depreciable life of solar panels is 85 of the full solar system cost which may be depreciated roughly as follows.

The basis of depreciation for the widget machine is the full 500 000 for a savings of 155 000.

Qualifying solar energy equipment is eligible for a cost recovery period of five years.